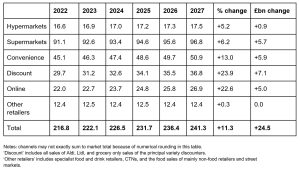

The UK grocery market is set to grow by 11.3% over the next five years, with discounters

expected to be fastest-growing grocery channel in that period as the cost-of-living crisis replaces Covid as the key challenge to the sector.

The data, released today by IGD, reveals that the value of the market as a whole will from grow £216.8bn to £241.3bn by 2027.

The growth will be driven primarily by inflation this year, with a predicted value increase of 3.5%, but this is expected to moderate from 2023 onwards.

As the war in Ukraine also continues to impact the UK supply chain – with food prices expected to increase by 8.9% this year – IGD predicts shoppers will be looking to make real cuts to their shopping budgets.

Discount will be the fastest growing channel over the five-year period, with a forecasted growth of 23.9% to £7.1bn. This will be driven by more households looking to make savings and both Aldi and Lidl continuing to expand their store networks with ambitious opening targets for 2025 (1,200 and 1,100, respectively).

READ MORE: Discounters Aldi and Lidl continue to grow as grocery inflation hits 4.3%

IGD said the discount channel growth would be higher, were it not for competitive supermarket pricing strategies and the risk of “sales cannibalisation” where discounter catchment overlaps.

Variety and high street discounters – such as B&M and Home Bargains – are also expected to be “sharpening their grocery offer”.

“Our new forecast sees growth for all retail channels,” said IGD’s director of retail analysis, Caroline Myers.

“Though discount will naturally benefit from shoppers’ desire to save money, growth will be held in check by increasing competitiveness from other channels.”

Myers added that many shoppers on tight budgets will “adopt a more-for-less mentality”, managing their shopping basket by choosing cheaper ranges, moving away from brands and seeking out the best promotions.

“Shopping will also be more planned, with many switching to more overtly value-focused retailers,” she said.

“Retailers’ sales will however be supported by shoppers eating out less often, building demand for at-home entertaining and premium meal solutions.”

READ MORE: Lidl accuses Tesco of copying logo in £2.35m High Court dispute

Maxime Delacour, IGD senior retail analyst and specialist in the discounter channel, said: “Although like-for-like growth has been a challenge for the discounters, they are well-placed with the cost of living crisis to appeal to shoppers’ increasing savvy behaviour.

“Attracting new shoppers will be key, with Lidl in a strong position here to use its Lidl Plus app to encourage loyalty.”

Following a slight decline last year, against the huge surge in business seen during the pandemic, online grocery is expected to rebuild momentum and will outpace discounters from 2025 onwards.

Growth is predicted to pick up as retailers deliver new order capacity and expand their rapid delivery services, reaching 22.6% by 2027. Cost pressures and increasing competition means that delivering profits is likely to be prioritised over sales growth, particularly in the short term.

A focus on local neighbourhoods and investment leading to an improved store offering is also expected to give the convenience channels a boost over the next five years, with 13% growth predicted overall.

Channel values (£bn)

Click here to sign up to Grocery Gazette’s free daily email newsletter