In the wake of a challenging year for the plant-based industry, it appears Veganuary, the annual month-long pledge to only eat plant-based foods, might be facing a dip in popularity.

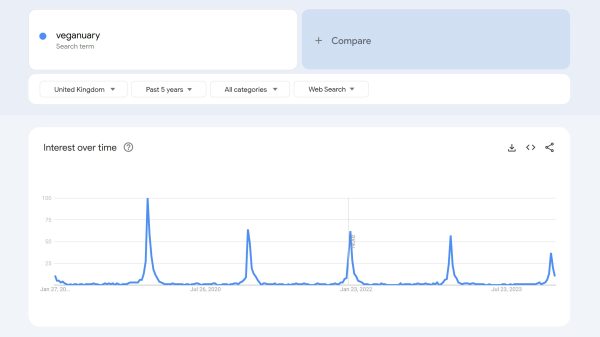

Early indications have revealed a decline in online searches for the term, with Google users’ interest in ‘Veganuary’ waning, with search volumes at just 54% of its 2019 peak. Industry experts cite a list of reasons, from inflationary pressures to general Veganuary fatigue.

And while sales of own label plant-based ranges increased 8% in the four weeks to 21 January, according to Kantar, that is not exactly a surging performance

Is interest in Veganuary waning?

Retail industry veteran Richard Hyman, partner at Thought Provoking Consulting, believes that interest in Veganuary has dipped because “the novelty has worn off” – both among retailers and shoppers.

However, he also thinks it highlights a deeper issue in the plant-based world. With the cost-of-living crisis raging on, Hyman believes some shoppers are put off buying vegan food due to the higher prices of some goods.

“There may be some fatigue, but the big factor is the broad economic one. When push comes to shove, it’s personal economics that really is the biggest influence on behaviour.

“Where are consumers are going to make their cuts with less money to spend? They can’t make their cuts with energy, mortgage or transport, so it’s spending in areas like food, clothing, and putting off buying a new television.”

Therefore, Hyman believes the biggest question is “does vegan food carry a premium?”. According to him, the answer is yes.

Recent data support his claim, and show that vegan product prices had risen faster than their meat and dairy counterparts amid soaring inflation.

An Evening Standard analysis last year found that vegan products across UK supermarkets saw an average price increase of 18%. Specific categories like plant-based pizza prices surged 42%, vegan cheese rocketed 28% and plant-based alternatives to meat, ice cream and milk rose between 19% and 25% over the year.

Hyman believes initiatives such as Veganuary will do little to convince cash-strapped shoppers to choose food options that are more expensive.

“I don’t think bells and whistles can change the fundamental reality which is people have less money to spend,” he said.

Indeed, The Conversation cites a University of Oxford study that found that during Veganuary 2023, sales increased for plant-based foods that were on promotion, but not for those which were not on promotion.

Challenges facing Veganuary

Premium prices and inflation-strained budgets are not the only factors that might be deterring consumers from fully embracing this year’s Veganuary.

Not just the initiative, but plant-based diets as a whole has been battling against false perceptions, says Elin Roberts, the CMO of vegan food brand Better Nature Tempeh, which is sold in retailers including Tesco and Asda.

“The main challenge for us is the perception that plant-based brands are one ultra-processed entity that is performing poorly and this is impacting people’s interest and confidence in the space,” she says.

Roberts is not the only vegan brand exec to flag false perceptions about plant-based products.

Most notably Beyond Meat CEO Ethan Brown blamed the brand’s financial challenges last year on this.

He said “This change in perception is not without encouragement from interest groups who have succeeded in seeding doubt and fear around the ingredients and process used to create our and other plant-based meats.”

Some vegan brands are actively fighting against this “ultra processed” tag, with plant-based brand This revealing it was working on a line of “virtually unprocessed” products which are set to be launched this year, in response to consumers becoming more concerned about the health and nutrition of vegan products.

However, Better Nature Tempeh’s Roberts is at odds to point out that, while consumer demand for plant-based food has dipped over the past year, it has not shrunk “nearly as much as the media has made it seem”.

In fact, she adds, there are success stories throughout the industry such as with Better Nature Tempeh’s Veganuary performance this year so far eclipsing previous years.

“This has been our most successful Veganuary yet. Tesco sales are stronger than ever, we’re sold out across most Whole Foods stores, our Tempeh is being used in fast-growing businesses like Planthood, Grubby and Pack’d, and we’ve celebrated an exciting new launch into Asda where we’re sold out in many stores,” says Roberts.

A new approach to Veganuary

Roberts also highlights shifting consumer attitudes to eating vegan, with shoppers moving away from the traditional, strict ‘vegan-only’ approach as outdated.

She notes that flexibility is now a big trend, with people “not cutting out but adding in”.

“Shoppers are not as interested in cutting out completely. We’ve seen ‘vegan’ as a label becoming less popular and claims like ‘healthy’ and ‘sustainable’ performing better,” she says.

Initial data appears to show this new approach being prevalent in Veganuary.

Kantar head of retail and consumer insight Fraser McKevitt says: “Health always comes to the fore as a priority for consumers in January, but what’s interesting this month is that we’re not seeing as big a spike in health-related categories as we have done in previous years.

“That’s because people are now buying more of the typical January ‘health kick’ items throughout the year. 9% of annual own label plant-based sales were made in January in 2023, a steady decline compared with the 11% of sales in 2020.”

Brands and retailers alike have jumped on this more flexible approach to eating plant-based food.This more flexible approach and a shift in consumer behaviour seems to have been also been adopted by brands and retailers alike.

Dairy-free butter alternative Pure is calling upon consumers to take a “gentler approach to lifestyle changes to help them adopt a plant-based diet gradually”, rather than attempt Veganuary “cold turkey”.

Research conducted by the brand found Brits who gave up Veganuary did so after struggling to make so many dietary changes at once, while a further half (45%) would consider going plant-based if there was less pressure to go completely vegan all at once.

Pure senior brand manager Alexandra Moston says: “With so many Brits struggling to keep up with the huge number of dietary changes that come with going completely plant-based in January, we are encouraging everyone to make small, everyday swaps throughout the year instead.

“Changing your whole diet overnight is notoriously tricky to maintain, but with Pure’s range of plant-based spreads you can still create your favourite meals and snacks with just a simple change to your weekly shop.’

Supermarket giant Tesco has also noted the desire to make small changes rather than big sweeping transformations about how we eat.

Last week, Tesco revealed that while shoppers were committed to “healthier diets” they were also leaning towards “more accessible” diets, adding that its research highlighted that consumers no longer “have to make major changes or set drastic resolutions”.

“61% of the UK admitted that when they make a small change to their diet – such as committing to a ‘meat-free day’ or adding one or more extra portions of fruit or veg to their plate – they’re more likely to stick to it, rather than a major change such as becoming vegan,” said the grocer.

So as another Veganuary concludes, it appears that consumers may be taking a different approach to the plant-based pledge. Afterall, eating vegan isn’t just for January.