M&S and Waitrose are both renowned for their ‘upmarket’ stores and more affluent shopper base.

While Waitrose has long been seen as the middle class shop of choice, the past year has seen M&S welcome new customers as it invests in value, widening its range and refreshed stores.

While M&S’ market share has grown, Waitrose’s has been slowly declining and the two are now neck-and-neck. Grocery Gazette looks at why shoppers are switching to M&S and if it’s only a matter of time before it overtakes Waitrose?

The gap narrows

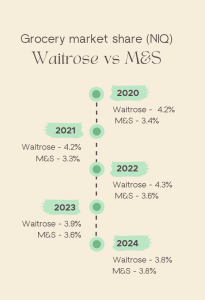

Over the past four years, M&S has been creeping its way up the grocery market share ladder and last month, it officially drew with Waitrose with both now holding 3.8% of the market.

It marks a significant jump from 2021 when M&S held just 3.2% compared with Waitrose’s 4.2%.

Although, as M&S chief executive Stuart Machin asserted last month, it isn’t focused on one particularly competitor, he did admit that Waitrose was one of the chains it had “taken share from”.

According to NIQ, M&S was the fastest growing food retailer over the last 12 months, with sales up 13%. NIQ head of retailer insights Mike Watkins says its performance has been “quite phenomenal” and way ahead of the 9.4.% growth across the

“it’s growing twice as fast as many competitors and also a lot faster than Waitrose. The reason for that growth is they have attracted a lot of new shoppers.”

Why are shoppers switching to M&S?

Over the past year, M&S has ramped up its value offer as it looks to become a destination for a larger food shop and not just a place for a few treats.

In May, Machin said M&S’ value perception is “the strongest it’s been in history” and it has continued to invest in price since, rolling out its latest round of cuts last month across over 200 products.

Watkins says that the M&S shopper base is expanding, as “a lot of people are going to M&S rather than other retailers for their food”. Value is a key factor behind this, with Watkins applauding the retailer’s Remarksable offer as “a really great example of being able to reset price perception”.

Retail Economics senior consultant Nicholas Found agrees that M&S’ “strong value for money” is key to why so many are switching to the grocer.

However, he also believes that the retailer’s investment in its stores, digital infrastructure and products “offers a vastly improved experience”.

M&S has been pushing ahead with its aim to become the UK’s leading omnichannel retailer. Its store rotation programme will see it move from a base of 247 stores to 180 higher quality, higher productivity full line stores, alongside more than 100 new bigger food sites by the financial year 2027/28.

Found says that the rollout so far has “significantly enhanced the in-store experience, winning back the hearts of shoppers with a fresher, more appealing store environment”.

“This has been underlined by restructuring its cost base to support lower prices and its product offering at a time when consumers are feeling squeezed from inflation and pessimistic about personal finances. These changes have re-energised its value proposition, through lower prices, high quality products, and experiences in refurbished stores that delight shoppers,” adds Found.

Savvy Marketing chief executive Catherine Shuttleworth agrees that “the biggest thing has been its investment in shops”.

“Waitrose hasn’t had the same level and speed of capital investment that M&S has,” she says.

Shuttleworth also believes that M&S now has “a really targeted shopper” of families and says it has refocused its range around this.

“It’s increased its frozen footprint fairly significantly, it’s been clear about value messaging, and it feels like a modern, contemporary take on family food shopping. Particularly in things like breakfast cereals, home cleaning products – it didn’t have a range that stood up to the shoppers requirements but it’s filled those gaps, and you are seeing shoppers now doing a much bigger, fuller shop which is why it’s managed to increase the market share,” she says.

Found says that for M&S to continue this positive momentum, it should continue its focus on offering convenience, consistency, and value.

“Further investments in store renovations, digital innovations, and product diversification will keep customers engaged and loyal. Strengthening its value proposition through competitive pricing and quality offerings will be crucial in retaining and attracting customers.”

Why is Waitrose losing market share?

Since 2021, Waitrose market share has fallen from 4.2% to 3.8%. While this may not be a dramatic fall in the midst of a cost-of-living crisis, it is in stark contrast to M&S’ share gains.

Waitrose parent company, the John Lewis Partnership, has been struggling of late and last year reported a loss of £234m, forcing it to scrap the annual staff bonus.

But despite reports of up to 11,000 jobs being a risk as the business looks to cut its cost base by £900m over the next five years, White has claimed the business will “more than break-even” this year and that both Waitrose and John Lewis are on track to “build back to sustainable profit”.

Detail Business Consulting managing director Paul Meechan says that Waitrose has “taken its eye off the ball in terms of marketing their team, service, and what their customer wants”.

“It really doesn’t know what it’s about – it’s made so many changes within the business,” he says.

Meechan also wonders whether a lack of store coverage may also be a factor as to Waitrose lack of growth. “M&S is not quite everywhere these days, but it’s in far more locations than Waitrose,” he says.

When it comes to stores, Shuttleworth says that Waitrose could improve the look of its “quite tired” stores.

However, she says that more importantly, it needs to be “really clear and communicate with customers what the strategy is”.

“What’s tricky is that Waitrose is going through a process of change and transformation but it’s not clear yet. So we know with M&S what its plan is – I don’t think we know that with Waitrose. There are improvements, but it is a more complex operation.”

Like M&S, one area that Waitrose is investing in, is upping both its value and ethical credentials.

Earlier this month, Waitrose invested £30m to cut prices on hundreds of own-brand products and relaunched its food-to-go range with a renewed focus on animal welfare standards, British ingredients, and sustainable packaging.

Will M&S overtake Waitrose?

Ultimately, Watkins says that Waitrose has felt “some collateral damage by the resurgence and growth of M&S.”

According to NIQ data, over the 52 weeks, more than half (52%) of the population have shopped at M&S and its basket spend has gone up 5%. Whereas Waitrose currently only has 28% of households shopping at its stores and spend per visit has gone down 4%.

“They’re not spending as much at Waitrose, they’re spending more at Tesco or Sainsbury’s or Aldi and Lidl. So the key point is M&S have a greater shopper reach, they can amplify anything they’re doing and get a bigger impact,” he adds.

Found agrees that M&S’ investment in value and stores has made it “a destination among aspiring classes at a time when Waitrose has been slower to react to inflation and market trends, leaving it out of kilter with the needs of middle-class shoppers”.

“With its focus on affordability, quality, and convenience, M&S is poised to solidify its position in the market,” he says.

However, Found adds that M&S should “remain cautious”.

“Squeezed budgets mean households inevitably have to cut back somewhere, including home categories slipping down spending priorities compared to essentials and holidays this year.”

Meechan says that he’d be “surprised” if M&S hasn’t overtaken Waitrose in terms of grocery market share in the next 12 months.

He also believes it will take “share directly from Waitrose”. “I could see Waitrose going down to 3.5%,” he predicts.

Industry watchers are united in their belief that M&S will overtake Waitrose in the year ahead as its investments into value and stores that have been underway for some time, continue to drive market-beating results.