Grocery Gazette speaks to CARTO chief marketing officer Florence Broderick

Can you tell us a little about yourself and Carto?

Can you tell us a little about yourself and Carto?

CARTO is a location intelligence platform that enables companies to turn spatial data into different business outcomes.

In telecoms that may be deciding where to roll out 5G; in transport that may be identifying optimal locations for EV charging points or in retail and CPG it may be selecting ideal sites for ghost kitchens, points of sales or stores.

I work as chief marketing officer of CARTO, working closely with customers in a wide range of sectors to get the most out of their location data and source new data to enrich their analysis.

In the UK, this includes brands such as Deliveroo, Vodafone, Bumble, Asda, Network Rail, Procter and Gamble and Coca-Cola – all of which use our platform to make more spatially-aware decisions.

How important are geospatial data and geomarketing to the grocery sector? What benefits can it bring?

Geospatial data and geomarketing are becoming increasingly important for the grocery sector.

By analysing location data, retailers and manufacturers can gain insights into consumer behaviour and preferences, allowing them to make data-driven decisions about product placement, pricing, and promotions.

This can help retailers optimise their store layouts, ensuring that the products consumers are most interested in are easy to find and purchase.

Location data can also help retailers identify areas with untapped demand for specific products, enabling them to tailor their marketing efforts to specific regions or demographics.

Additionally, geospatial data can help retailers better understand their competition and make strategic decisions about where to open new stores or expand their distribution networks.

Overall, the benefits of using location data in the grocery industry are numerous and can help retailers and manufacturers stay ahead of the competition in an increasingly competitive market.

Can you give us some examples of how data and insights can work in a practical sense, in terms of both deliveries and site selection?

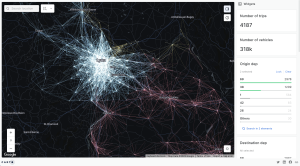

One great example would be Asda. As well as core use cases around site selection, the Asda To You team uses location intelligence to make informed decisions about where to locate parcel lockers.

By analysing data on demographics, partners, competitor locations, and transportation networks, Asda is able to identify locations where the catchment area has the greatest number of consumers with a propensity to use parcel lockers for certain partners.

For example, if you partner with an apparel brand focused on consumers age 18 to 30 – you may wish to choose locations near universities or areas densely populated by students.

All in all, this enables the Asda to ensure higher levels of usage and greater profitability in the process.

Another example would be how large CPG (or FMCG) brands use spatial modelling.

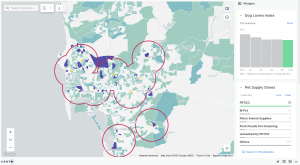

In this post, you can see how a shopper insights professional might use location data to identify demand hotspots for the organic category.

The process involves collecting data on store locations, product sales, and demographic information, and then using spatial analysis techniques such as clustering and heat mapping to identify areas with high demand for certain products.

If you take a product such as plant-based milk, using data on POIs (points of interest) for high end coffee shops or areas with a high concentration of offices and foot traffic where large amounts of takeaway coffee is sold are ideal locations to identify more points of sale, which can be used by sales and marketing teams to focus their efforts.

What types of spatial data are used most in this industry?

- Demographic data: Demographic data provides information on the characteristics of people living in a specific geographic area, including age, income, education, and ethnicity.

Retailers and CPG companies use this data to identify their target customers and tailor their marketing strategies accordingly.

- Traffic data: Traffic data provides information on the number of people or vehicles that pass through a specific area, such as a street or a shopping mall. Retailers and CPG companies use this data to identify high-traffic areas and optimize store locations.

- Land-use data: Land-use data provides information on how different areas of land are used, such as residential, commercial, or industrial. Retailers and CPG companies use this data to identify areas with high potential for foot traffic and sales.

- POI / competitor data: Competitor data provides information on the location and performance of competitors in a specific geographic area. Retailers and CPG companies use this data to identify areas where they can gain a competitive advantage.

- Behavioural data: This includes insights from social media and web browsing data, creating segments to understand consumer behavior based on posts and interactions.

The grocery sector is facing a number of challenges at the moment, with consumers spending less, costs rising as inflation soars, and increasing supply chain issues leading to empty shelves and product shortages. How can location intelligence help with grocery retailers ?

We are constantly seeing new use cases emerging in the sector. Beyond demand analysis we also see a lot around optimising supply chain management.

Location intelligence can help grocery retailers optimise their supply chain management by providing real-time data on the status of their inventory and supply chain.

By using geospatial data, retailers can identify the most efficient and cost-effective routes for transportation and delivery, as well as the best locations for warehouses and distribution centres.

They can also monitor and predict potential disruptions, such as weather events or traffic congestion, to mitigate any negative impact on their supply chain.

Equally, we are seeing more brands wanting to enhance the customer experience.

Location intelligence can help grocery retailers enhance the customer experience by providing personalised offers and promotions based on the customer’s location, purchasing history, and preferences.

Retailers can also use location-based marketing to reach potential customers in the vicinity of their stores, driving footfall and increasing sales.

Why is CARTO different from other location intelligence platforms and what is its most significant achievement in the grocery sector over the past year?

There are a few reasons why players in the grocery industry choose CARTO for their location intelligence needs:

- User-friendly interface: CARTO has a user-friendly interface that allows users to easily create, edit, and share maps and visualizations without the need for extensive technical knowledge, unlike some of the legacy GIS (geographic information systems) tools out there.

- Powerful data visualisation tools: CARTO provides users with a variety of data visualisation tools that enable users to create stunning and insightful maps based on extremely large datasets. This makes it easier to share insights around the organisation.

- Advanced analysis capabilities: The platform enables users to perform advanced spatial analysis, such as clustering, routing, and geocoding, using Spatial SQL. Many of these functions are point and click, saving data analytics professionals a lot of time in their workflows.

- Customisable and scalable: We allow users to customise and scale their applications to meet their specific needs, making it an ideal platform for both small and large organisations.

- Cloud native: the platform is cloud native for Google Cloud, AWS, Snowflake and Databricks – meaning that data professionals don’t need to move their data from one platform to another.

We extend the geospatial capabilities of those data warehouses making it much easier for a wider range of people to use and analyse geographic data across CPG and retail organisations.

What do you believe is the most pressing concern in the grocery sector for 2023, and how can business prepare to face it head-on?

The continued evolution of consumer shopping habits and preferences. The pandemic may be be “over”, but consumers have become more accustomed to ecommerce and digital channels for grocery shopping, and this trend is likely to continue in the future.

Therefore, grocers and FMCG brands should prioritise investing in their ecommerce infrastructure, including their online ordering and delivery capabilities, to meet the increasing demand for online shopping.

Grocers can also benefit from integrating technology such as AI and machine learning into their systems to provide personalised recommendations and enhance the customer experience.

In addition, sustainability is another critical issue that grocers and FMCG brands should address in 2023.

Consumers are becoming more environmentally conscious and are looking for sustainable and ethically produced products. Grocers should ensure that they offer sustainable and environmentally friendly products and packaging and reduce waste through recycling and other initiatives.

Click here to sign up to Grocery Gazette’s free daily email newsletter